|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Loans for Subcontractors: Navigating Financial OpportunitiesSecuring a home loan as a subcontractor can be challenging, but understanding the process can open up new opportunities. This guide offers insights into the essential aspects of home loans for subcontractors. Understanding the BasicsHome loans are pivotal for many subcontractors seeking to purchase property. However, without a traditional employment structure, it is crucial to understand how lenders assess your application. Income VerificationLenders typically require proof of income. As a subcontractor, you may need to provide tax returns, bank statements, and contracts to substantiate your earnings. Credit Score ImportanceA good credit score can significantly impact your ability to secure a favorable loan. Paying off debts and maintaining a healthy credit line can enhance your creditworthiness. Strategies for ApprovalThere are several strategies subcontractors can employ to improve their chances of loan approval.

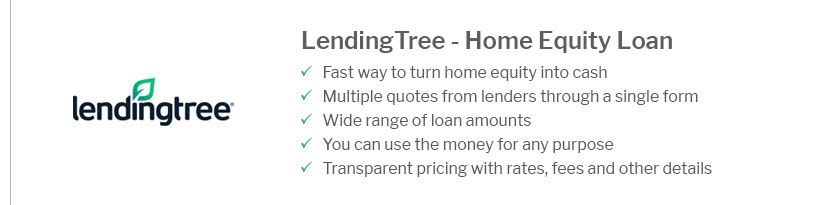

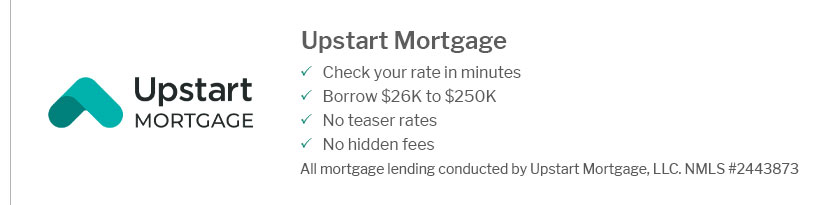

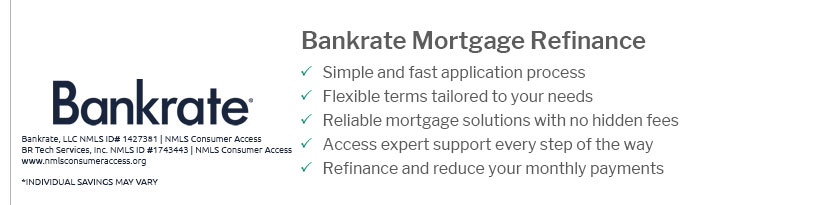

Consider utilizing resources to home equity quotes to evaluate your current financial standing. Exploring Loan OptionsSeveral loan types might be suitable for subcontractors. Conventional LoansThese loans typically require a strong credit score and steady income documentation. However, they can offer competitive interest rates. FHA LoansFederal Housing Administration loans may provide more lenient credit requirements and lower down payments, which can be beneficial for subcontractors. It's beneficial to compare loan mortgage quotes to find the best option for your situation. FAQ

https://www.fnba.com/mortgage/self-employed/

As a self-employed individual or independent contractor, you will need to prove that your income is sufficient and that it will meet your mortgage obligations. https://www.lendingtree.com/home/mortgage/how-to-get-a-self-employed-mortgage/

What goes into your qualifying income varies depending on whether your business is a sole proprietorship, partnership or corporation. Lenders want to make sure ... https://www.bankrate.com/mortgages/self-employed-how-to-get-a-mortgage/

It's possible to get approved for a home loan as a self-employed borrower, but you often have to take a few extra steps to prove your ...

|

|---|